What Is a Payment Gateway?

With the intention to provide a smooth and secure payment system, businesses of all sizes build a payment gateway — an online payment service that mediates the merchant and their customers and ensures secure data transfer.

This technology uses a special coding system called SSL connection, that encrypts all sensitive financial data to prevent data leaks or fraud. The safety and stability of the payment gateway system are determined by PCI-DSS standards and regular supervision and certificate confirmation of the correspondence to the standard.

Once the client is ready to pay for a good or service via the Internet, he initiates the transaction through the payment gateway. After collecting the payment information such as credit card number, CVV, and expiry date, the gateway encrypts and sends the sensitive data to the bank or other payment processors, and sends it back with the approval or denial of the transaction. Such an intermediary stage significantly facilitates the payment flow by using security protocols on the data obtained from various websites and devices and brings advantages to both sides of the deal.

Having the general overlook of the payment gateway notion obtained, we can take a broader look at the Process of Data Delivery with Payment Gateway:

- Data Share: client shares the card detail and the system encrypts it with SSL security protocol.

- Merchant Data: once the merchant gets the information on the deal, they transfer the financial data, correspondingly protected with SSL, to their payment gateway.

- Message Transformation: the payment gateway at this stage changes the format of data obtained, and passes it to the acquiring bank or processor.

- Data Submission: as soon as the processor gets the financial data, it passes it to the corresponding bank system, the bank considers the request and sends back the reply to the processor.

- Obtaining the Reply: the payment gateway, after receiving the reply of the payment processor, shares it with the client and merchant, which at this point gets notified of the success/denial of their transaction.

- Post-Transactional Issues: merchant terminates the deal by sending the authorisation info and transaction approvals to the acquiring bank in a batch form. The payment is executed, however, during the next 24 hours, the bank keeps the money transfer on deposit to safeguard the process.

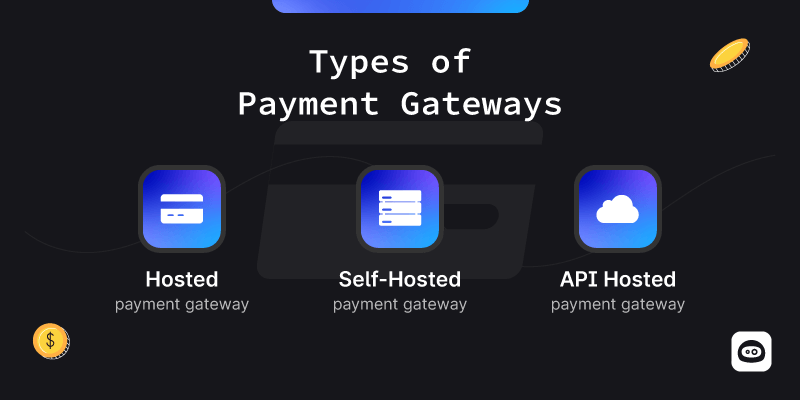

Three Types of Payment Gateways

To get you better understanding of the payment gateway, we should note that there are several different types and approaches to developing it. All of them are dedicated to safe and easy financial transfers, but still have some differences, as developers may vary in their priorities and technologies used. Let’s get an in-depth view of each of the types:

Since you have a commercial website, offer services or plan to create an online store, the need for payment gateway integration will soon arise. With a clear understanding of how the payment gateway function, you may hesitate with the implementation of this software. In the next chapter, let us discover, what type of businesses can take advantage of payment gateway installed to their software.

Who can Benefit from Payment Gateway Integration?

There is no simple market sector where applying a payment gateway would work best. The number of reasons why each business may opt for this system can vary upon the market spheres, but we outlined the most common venture groups that can succeed in installing a payment gateway:

- IT sector:

- Commerce

- Payment Providers

- Banking Systems

- Billing Firms

As you can see, the list of businesses that benefit from payment gateway is rich but still not exhaustive. It is a win-win solution for both small startups and huge ventures due to the number of perks it brings to the business. Not sure? Keep reading to find out all keystones of launching the payment gateway.

Custom Payment Gateway Development Vs. White-Label Gateways. What To Choose?

There are two ways to follow when initiating the payment gateway integration: building your own software from scratch or applying a ready-made third-party solution.

What is Custom Payment Gateway?

With a custom payment gateway, you do everything on your own and create a unique product. You hire a team of software developers, engineers and other experts, calculate the risks and perspectives, outline the custom features you want to install, and control the full development flow.

What is a White-Labeled Payment Gateway?

A white-labelled payment gateway is a predeveloped solution that uses API technology for its smooth and seamless connection to an already existing website or platform. Software providers initially develop such products to be rebranded and used with the naming and logo of the client. Having bought such solutions, the company still needs some technical experts’ assistance to complete integration to its software.

Advantages of Custom Payment Gateway Integration

We know how challenging may be the decision-making process, especially when it comes to large investments and risks. To bring you more confidence in the integration of a custom payment gateway, let us discuss, how it can benefit your business.

Tailor-made features

With the software developed from scratch, you are not limited in the number of customised instruments, applied to the system. While ready-made platforms either pose unreasonably high fees or bound features available for your price plan, the custom-developed platform makes it possible to implement unique features, such as personalized payment flows, loyalty programs, customer notification systems, and individual order registration forms.

A few digital payment providers offer mobile payment integration, cross-border billing, and instant debit and credit card transfers. This way, with custom developed platform, the list of instruments possible to integrate into your payment gateway is limited just by your imagination. Embracing the highly professional team of developers, you can fulfil all wishes that seemed impossible with a predeveloped platform.

Economic benefit

Businesses’ intention to save funds on developing their own payment gateway by purchasing third-party software may turn out to be unpredictably disadvantageous. Since you pay the price for applying, using the gateway, as well as for every financial operation you do.

Moreover, with the ready-made payment solution, you are charged for functionality you do not even use in the workflow. Over some period of time, the amount of money spent on such software urges companies to consider developing a custom payment gateway, to make their business more cost-efficient.

Wide-ranging Integration

The prominent benefit of creating custom payment software is the possibility to integrate it into various other devices from smartphones to self-service kiosks, smart homes and cars. With the fast spread of the Internet of Things and Artificial Intelligence, almost all gadgets and machines support instant payment solutions. The task of the company owners is to guarantee seamless and secure transactions with the payment gateway technology.

Magnise Software Developers have years of expertise in IoT solutions for smart manufacturing and homes. Visit our website to see cases of successful IoT integration with direct payments.

Improved Security

Although most software developers pay much attention to the safety of their products and data leaks are not common on other developed payment gateways, there are some factors you should consider. Having a personalized security system within the payment gateway, allows your team of developers to get streamlined access to the payment end-points, and always be alert to prevent malware.

In addition, here you get the power to equip the system with all necessary security elements corresponding to The Payment Card Industry Data Security Standard (PCS DSS). Also, the range of security measures is vast: two-factor authentication (2FA), data encryption using SSL (Secure Socket Layer), biometric verification, one-time password etc.

Despite all the convenience and robust software solutions, custom payment gateway integration still has some stumbling stones:

- Budget Issue: although developing personalized software is economically more efficient in the long run, the primary cost is considerably higher than the monthly/annual fee in a predeveloped system.

- Paper Issue: as you decide to develop the custom software, you must be ready to deal with certification and payment settlement documentation.

Obviously, these challenging points do not compete with the extended list of benefits custom payment software brings to the business. Such uniqueness of the product, advanced features, proven security and scalability pave the way to the success of your venture.

Basic Components of Payment Gateways

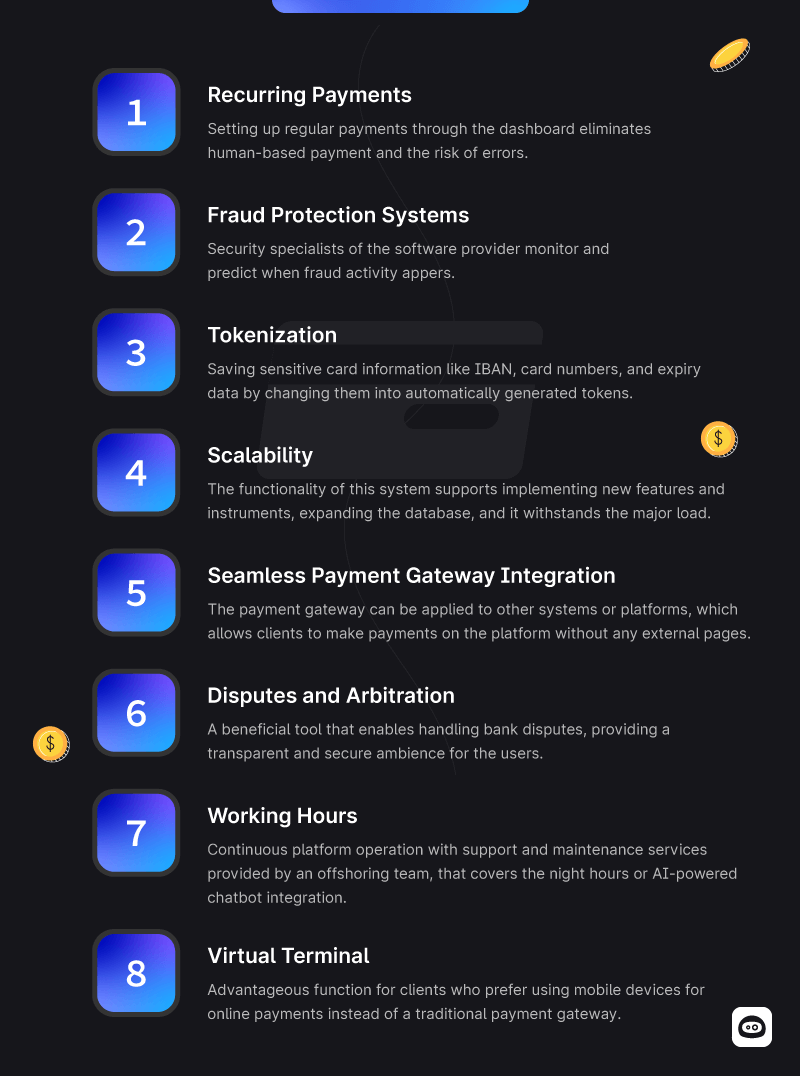

There is no single approach to creating a payment gateway. It depends on the company’s plans, needs and capacity. The task is not to overload the software with excessive functions so that it does not harm its functionality and performance, but at the same time preserve all the important elements of the software. Let us make a list of features that will surely prove valuable and provide you will all the necessary functionality. They are the following:

Mobile App Payment Gateway Integration

The essence of payment gateway integration into mobile applications attracts interest as we can no longer imagine our daily life without smartphones in our hands. Paying bills, booking hotels or buying goods from supermarkets — everything is done with one tap on the screen.

It’s no wonder that most businesses tend to install payment software on smartphones to enable a quick and delightful user experience.

Stages of Mobile App Payment Gateway Integration

Such process can differ depending on the provider, but the key steps are as follows:

1. Setting up a merchant account

The first task of the company is to create a merchant account with a payment processor, which handles the actual processing of the payments. After that, the company creates an account with the chosen payment gateway provider and links it to the merchant account.

2. API credentials obtaining

API is a technology used to interconnect two or more pieces of software and make them communicate without lags. To make your gateway communicate with the application, you need to obtain API credentials from the gateway first.

3. Configuration

Next, the configuration stage starts. Here you do the final settings and indicate the payment options, recurring payments, security issues and other requirements for the app.

4. Payment gateway implementation

Now comes the time to add the credentials and code snippets to your application. Having the integration done, the app will get permission to send transactional data to the payment gateway and obtain the approved/denied reply. In other words, it starts performing as a payment gateway.

After that, the testing stage should be done to make sure the system works smoothly and it functions well.

5. Application Launch

As soon as the testing stage proved the application’s effective and flawless performance, your company may launch the mobile app with an integrated payment gateway and offer your clients to use it.

Now you see that process of gateway integration into the mobile app does not pose any challenge if you rely on professionals. But now the discussion of the legal and security aspects of the payment gateway development would be our next stop.

Requirements for Payment Gateway Integration

Legal and cybersecurity compliance should always be of primary importance, otherwise, it can lead to negative consequences and jeopardize the company’s reputation among the clients. Take a look at the main requirements needed for unquestionable gateway functioning:

- PCI DSS Compliance

Payment Card Industry Data Security Standard regulates the rules for operating the personal data of the card owner, including data encryption, security and access controls. As your gateway complies with PCI DSS, your customers know for sure that their transactional information is stored safely.

- EMV

EMV stands for Europay, Mastercard, and Visa. It is an international finance security standard that applies chips on credit and debit cards and eliminates the risk of fraud.

- EMV 3-D Secure

It is a cybersecurity protocol that enables secure financial operations. The main idea is to prove the identity of the cardholder relying on the three domains: acquirer domain, issuer domain and interoperability domain.

- Tokenization

As we discussed earlier, tokenization is one of the most safe methods to share sensitive data. Companies must make their software support this technology by strengthening the hardware functionality and deploying PA-DSS-friendly software.

- P2PE

Another type of encryption is point-to-point, or end-to-end which is responsible for connecting the different devices without risks of data leak via open network.

- HSM

HSM or hardware security module is a technology responsible for creating keys, performing the crypto operations with them and providing the protection of the transfers.

Payment Gateway Development Partners

After all, under the scope of our interest came payment gateway integration. We outlined the notion of the payment gateway itself, its types, the pros and cons of its implementation and the major requirements needed to integrate it.

Now we can summarize that in order to be ahead of today’s digitalized world, companies from different industries must acquire the gateway technology to their website and mesmerize the customers with excellent payment performance and absolute data security.

If you are looking for a reliable partner to launch your custom payment gateway — contact Magnise. On our website, you can find the latest cases of software development.

Need a piece of expert advice? Magnise professionals are always here to give you a hand. Let’s get started!