Understanding Fintech

What is Fintech?

Fintech (financial technology) refers to the use of technology to provide innovative and improved financial services. It encompasses a wide range of applications, including mobile banking, online payments, digital currencies, robo-advisors, peer-to-peer lending, and more, aiming to enhance efficiency, accessibility, and convenience within the financial industry.

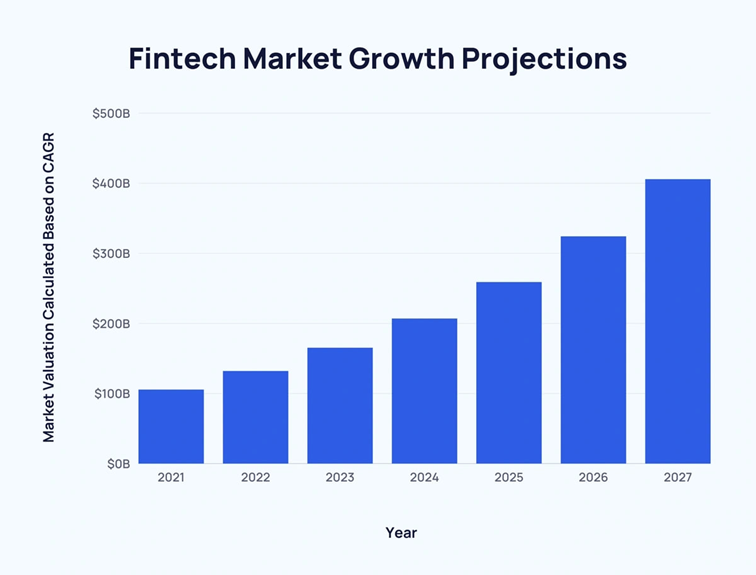

The fintech market is on a steady rise, growing year by year. Several factors are fueling this expansion. Innovations in technology, easier access, and lower costs are all playing significant roles. As a result, there’s a strong surge in demand from consumers.

Market experts predict even more growth ahead. According to Market Data Forecast by the year 2027, the fintech industry could surpass a remarkable $400 billion. This projection highlights the industry’s strong momentum, shaping a future of financial innovation and progress.

Key Technologies Used in Fintech

Let’s delve into the promising advantages of Fintech, starting with the main technologies used to create the products. This knowledge will allow us to quickly define and understand the real use cases it can bring.

AI and Machine Learning

AI and ML play integral roles in fintech. AI automates backend decision-making in lending and trading, while also enhancing compliance and security. Frontend AI powers customer services like chatbots and personalized budget advice. ML, used by companies like ZestFinance, aids in explainable predictive analysis.

Big Data Analytics

Working alongside AI, big data analytics predicts future outcomes based on historical data. It’s vital for cybersecurity, especially fraud prevention. Predictive analytics tools detect anomalies like suspicious emails and IP addresses, protecting fintech systems from cyber threats.

Application Programming Interface (API)

APIs drive fintech success by enabling software programs to communicate and access necessary financial data. This quick deployment tool empowers fintechs to swiftly bring products to market, maintaining their competitive edge.

Cybersecurity

Fintech’s integration with traditional finance has brought cybersecurity concerns. AI and Blockchain can enhance security and identify cyber threats. Despite financial limitations, prioritizing security during software development is crucial to maintain consumer trust.

Blockchain

Widely used in fintech, blockchain’s decentralized and encrypted data storage is transformative. Often called the “Uber of banking,” it simplifies payments, accelerates processes, and reduces costs. Blockchain’s adoption is set to increase in the coming years.

Fintech Use Cases

Let’s explore some of these fintech use cases that are making a big impact and reshaping the way we deal with our finances.

- Digital Payments and Mobile Wallets:

Fintech has revolutionized payments with mobile wallets like Apple Pay and Google Pay. Users can securely store their payment information and conduct transactions seamlessly using smartphones, enhancing convenience and security in both online and in-store purchases.

- Peer-to-Peer (P2P) Lending:

P2P lending platforms connect borrowers directly with lenders, eliminating traditional intermediaries. Individuals and small businesses gain access to loans, often at competitive rates, while investors can earn returns by lending their funds to various borrowers.

- Robo-Advisors:

Robo-advisors utilize algorithms and AI to offer automated investment advice and portfolio management. By considering factors like risk tolerance and financial goals, robo-advisors provide users with personalized investment strategies, democratizing investment management.

- Blockchain and Cryptocurrencies:

Blockchain technology enables cryptocurrencies like Bitcoin and Ethereum, facilitating secure and transparent peer-to-peer transactions without intermediaries. Beyond digital currencies, blockchain finds applications in supply chain tracking, identity verification, and more.

- Digital Banking and Neobanks:

Neobanks are fully digital banking platforms that provide online account management, budgeting tools, and enhanced user experiences. These platforms challenge traditional banks by offering streamlined services and user-centric features.

Artificial Intelligence (AI) and Machine Learning (ML)

Use Case 1: Fraud Detection AI and ML algorithms analyze vast amounts of transaction data to identify unusual patterns and detect potential fraudulent activities in real-time, preventing financial losses.

Use Case 2: Credit Scoring Lenders use AI-driven credit scoring models that consider non-traditional data sources to assess creditworthiness, expanding access to credit for individuals with limited credit history.

Use Case 3: Chatbots for Customer Support AI-powered chatbots provide instant responses to customer inquiries, offering personalized assistance and support around the clock, enhancing customer satisfaction and reducing response times.

Blockchain Technology

Use Case 1: Cross-Border Payments Blockchain enables secure and swift cross-border payments by eliminating intermediaries and reducing transaction fees, providing faster and cost-effective global money transfers.

Use Case 2: Supply Chain Finance Blockchain ensures transparency and traceability in supply chains, allowing stakeholders to monitor the movement of goods and enabling more efficient financing options for suppliers.

Use Case 3: Digital Identity Verification Blockchain-based digital identities offer a secure and tamper-proof way to verify users’ identity, streamlining KYC (Know Your Customer) processes and enhancing data privacy.

Application Programming Interfaces (APIs)

Use Case 1: Open Banking APIs facilitate secure sharing of financial data between banks and third-party fintech apps, enabling users to manage their finances holistically and fostering innovation in financial services.

Use Case 2: Investment Platforms APIs allow investment apps to access real-time market data, execute trades, and provide users with up-to-date portfolio information, enhancing transparency and user experience.

Use Case 3: Payment Integrations E-commerce platforms integrate payment APIs to offer a variety of payment options to customers, enabling seamless and secure transactions while expanding customer reach.

Big Data Analytics

Use Case 1: Personalized Financial Recommendations Big data analytics analyze users’ financial behaviors and preferences to provide tailored advice on budgeting, investment opportunities, and money management.

Use Case 2: Risk Assessment and Underwriting Lenders leverage big data analytics to assess borrowers’ creditworthiness by analyzing extensive data points, allowing for more accurate risk assessment and informed lending decisions.

Use Case 3: Fraud Prevention and Detection Big data analytics identify unusual patterns in transactions and behaviors, helping to detect potential fraud and protect users’ accounts and sensitive information.

Security

Use Case 1: Secure Account Access Fintech apps use biometric authentication methods such as fingerprint or facial recognition to ensure secure and convenient access to user accounts.

Use Case 2: Two-Factor Authentication (2FA) Biometrics complement traditional authentication methods by adding an extra layer of security, enhancing the protection of sensitive financial information.

Use Case 3: Contactless Payments Biometric authentication is integrated into mobile devices for contactless payments, ensuring secure and frictionless transactions with a simple touch or glance.

These five fintech use cases exemplify how technology is reshaping financial services, enhancing accessibility, efficiency, and user control over their financial activities.

Benefits of Fintech software

Fintech software offers a wide range of advantages that transform how individuals and businesses manage their finances and interact with financial services. Let’s take a look at some of them:

- Convenience and Accessibility: Fintech software brings financial services directly to users’ fingertips. Mobile apps and online platforms allow users to access and manage their accounts, make payments, and perform transactions anytime, anywhere.

- Cost Efficiency: Fintech solutions often operate with lower overhead costs compared to traditional financial institutions. This can result in reduced fees for users, making financial services more affordable.

- Enhanced User Experience: User-centric design and intuitive interfaces create seamless and enjoyable experiences. Fintech software simplifies complex financial tasks, making them accessible to a broader audience.

- Speed and Efficiency: Automation and digital processes streamline financial tasks such as account opening, fund transfers, and loan applications. This reduces manual paperwork and accelerates transaction processing.

- Security and Data Privacy: Fintech software employs advanced security measures, including encryption and biometric authentication, to protect user data and transactions from unauthorized access.

- Transparency and Real-Time Information: Fintech platforms provide real-time updates on account balances, transaction history, and investment performance, enabling users to stay informed about their financial status.

- Easier Regulatory Compliance: Fintech platforms often integrate regulatory compliance features, helping users adhere to financial regulations and report requirements more effortlessly.

Overall, fintech software empowers users with greater control over their financial lives, offering convenience, efficiency, and innovative solutions to traditional financial challenges.

Fintech Development Process

Fintech product development involves several crucial stages that guide the journey from idea to a fully functional and successful product. Here are the key stages:

- Conceptualization:

This is where the initial spark happens. Identify a market need or pain point and brainstorm innovative solutions. Consider user personas, market trends, and potential value.

- Market Research and Validation:

Dive deep into market analysis. Validate your idea through surveys, interviews, and competitor research. Ensure there’s demand for your solution and refine your concept accordingly.

- Design and Prototyping:

Create a visual representation of your product through wireframes or prototypes. Design the user interface and experience, ensuring it aligns with user needs and expectations.

- Development:

Turn your design into a functional product. Break down features into development tasks, choose the right technology stack, and start coding.

- Quality Assurance:

Rigorously test your product for functionality, usability, security, and performance. Identify and fix any bugs or issues to ensure a smooth user experience.

- Regulatory Compliance and Security Integration:

Navigate the regulatory landscape applicable to your fintech product. Integrate necessary compliance measures and robust security protocols to protect user data.

- Launch and Deployment:

Prepare for launch by setting up servers, databases, and necessary infrastructure. Execute a strategic launch plan to introduce your product to your target audience.

- Data Analytics and Optimization:

Implement analytics tools to gather user insights and monitor product performance. Use data to make informed decisions and continuously improve the product.

- Continuous Improvement:

Regularly gather user feedback and iterate on your product. Stay attuned to industry trends and emerging technologies to innovate and stay competitive.

- Ethical Considerations and Compliance:

Continuously uphold ethical practices, data privacy, and compliance with regulations. Prioritize the security and trust of your users.

Each stage plays a vital role in the overall fintech product development process, contributing to the creation of a valuable, user-centric, and impactful product.

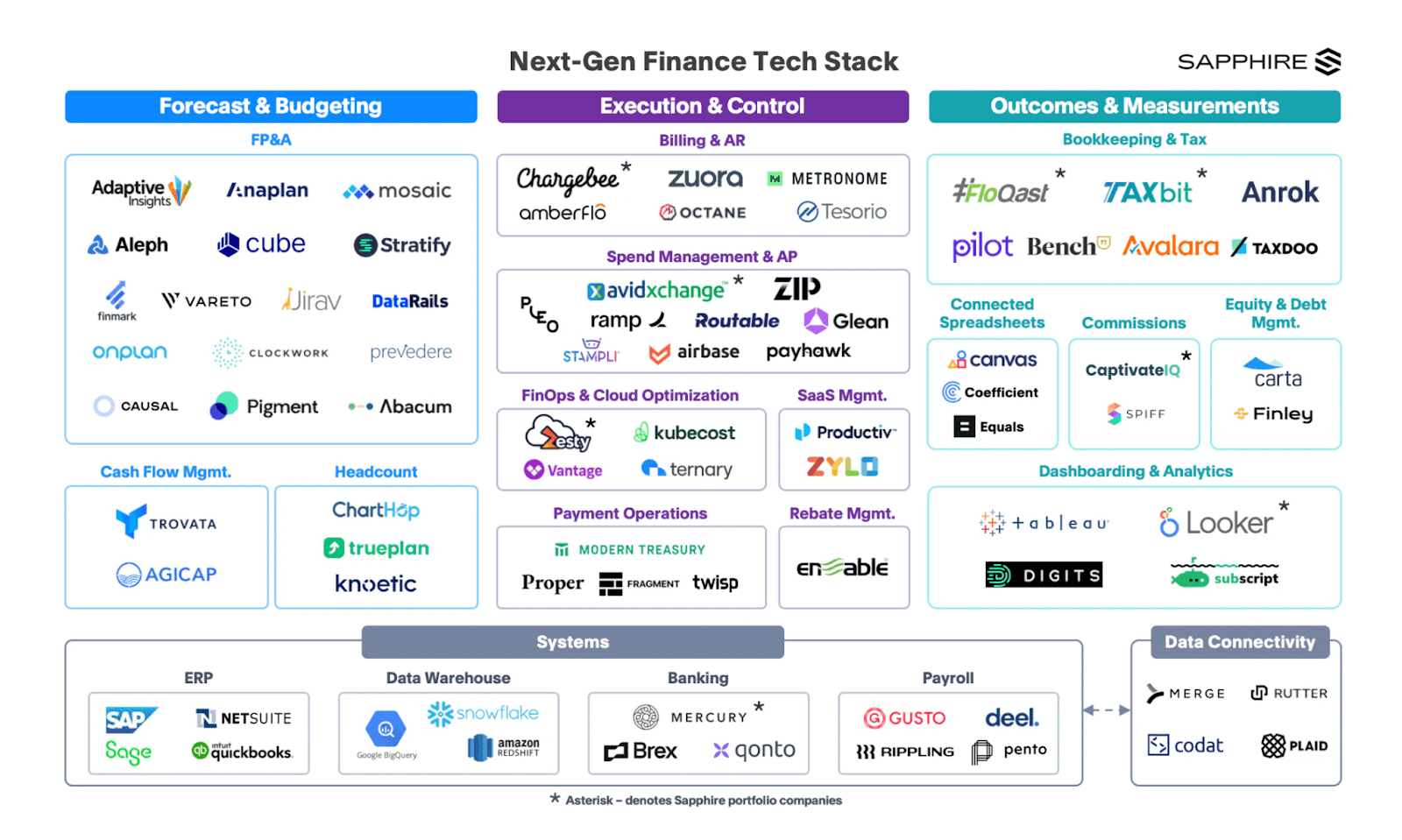

Tech Stack for Fintech

Choosing the right tech stack is crucial, as it can impact the product’s security, performance, and scalability. To excel in fintech, a diverse background encompassing finance, programming, data science, cybersecurity, and user experience is beneficial. Understanding financial concepts, coding languages, data analysis, and regulatory compliance is key. Knowledge of AI, blockchain, and business strategies further enhances your capabilities in this dynamic field.

Continuously adapting to new technologies and market trends is essential for success.

Challenges in Fintech

Fintech as well faces several challenges that impact its growth and evolution. These may include:

- Regulatory Compliance: Navigating complex and evolving regulations can be challenging. Fintech companies must ensure they comply with financial laws while innovating new solutions.

- Cybersecurity: As fintech deals with sensitive financial data, the risk of cyberattacks and data breaches is significant. Maintaining robust cybersecurity measures is crucial to protect user information.

- Customer Trust: Gaining the trust of users is essential. Overcoming skepticism about security, privacy, and the reliability of fintech services is a constant challenge.

- Data Privacy: Striking a balance between utilizing user data for personalized services and respecting privacy concerns is an ongoing challenge for fintech companies.

- Lack of Standardization: The lack of standardized protocols and interoperability can hinder collaboration between fintech companies and traditional financial institutions.

- Competition with Traditional Players: Fintech disruptors compete with established financial institutions, challenging traditional business models and sometimes facing resistance.

Navigating these challenges requires a combination of innovation, adaptability, strong partnerships, and a commitment to addressing customer needs while upholding security and compliance standards.

How to build a successful Fintech Product

Consider the target country

Choose the technology and the team of specialists

Consider possible integrations

Be flexible and ready with updates

Ensure security for the customer

Analyze the product and customer experience

Real-world Fintech Companies

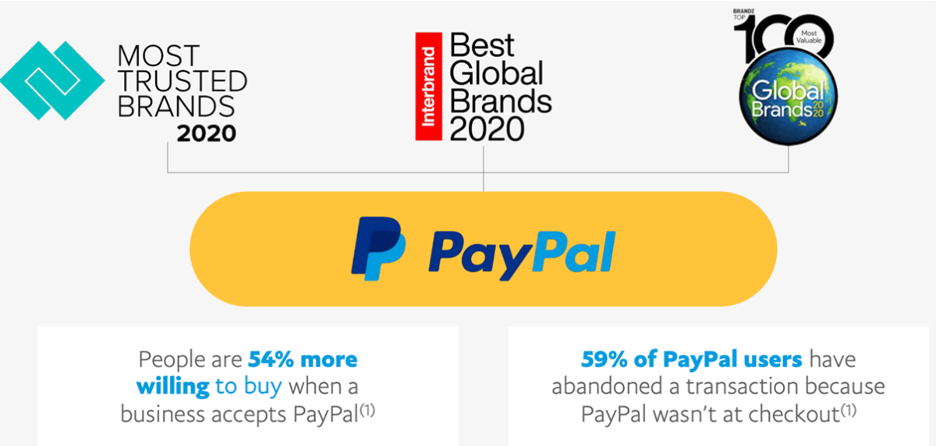

Finally, let’s take a look at one of the most successful fintech companies that, with its own example, created a standard for financial technologies – PayPal.

PayPal is a globally recognized fintech company that has played a significant role in revolutionizing the way online payments are conducted. Founded in December 1998 by Max Levchin, Peter Thiel, and Luke Nosek, PayPal emerged as a solution to address the challenges of secure online transactions during the early days of e-commerce. It went public in 2002 and was later acquired by eBay in 2002, further boosting its prominence.

PayPal is one of the pioneers of digital payments, allowing individuals and businesses to send and receive money electronically through its platform. Its initial focus was on providing a secure way for users to send money through email addresses.

PayPal’s evolution included strategic acquisitions to enhance its offerings. Notably, its acquisition of Venmo introduced a social payments element, allowing users to send and receive money in a social media-like environment.

Today, PayPal remains a leader in the online payment industry, offering a range of services including peer-to-peer payments, online merchant solutions, and digital wallets. Its role in shaping the fintech landscape has been significant, showcasing the potential of technology-driven financial solutions to revolutionize traditional financial transactions and services.

Conclusion

Developing a fintech product is a challenging but rewarding journey. By understanding the nuances of the industry, valuing user experience, adhering to regulations, and staying adaptable, you can create a fintech product that not only meets users’ needs but also drives innovation in the financial sector.

To ensure a successful product launch, the company must guarantee safety for the client as well as smooth and seamless processes.

Remember, the key to success is a combination of insightful strategy, meticulous execution, and a commitment to continuous improvement.

FAQ

Fintech product development refers to the process of creating financial technology products and services that enhance financial processes. This can include products like mobile banking apps, digital wallets, robo-advisors, peer-to-peer lending platforms, and more. Fintech product development involves design, technology implementation, testing, compliance, and launch, all while focusing on improving user experience, efficiency, and accessibility within the financial industry.

The five key technologies in fintech are: 1. AI and ML: Automation, customer service, predictive analysis. 2. Big Data: Predicting outcomes, fraud prevention. 3. APIs: Quick data exchange, product innovation. 4. Cybersecurity: AI and Blockchain for threat detection. 5. Blockchain: Decentralized data, streamlined processes.

Fintech product development differs from traditional product development due to several factors: - Regulatory Complexity: Fintech products often require compliance with financial regulations and data privacy laws. - Security Concerns: The handling of sensitive financial data requires stringent security measures. - User Trust: Building user trust is crucial due to the sensitivity of financial transactions. - Integration Challenges: Integrating with existing financial systems can be complex.

Startups with limited resources can approach fintech product development by: - Prioritizing MVP: Focus on developing a Minimum Viable Product (MVP) to test the concept's viability. - Leveraging Cloud Services: Use cloud platforms to reduce infrastructure costs and increase scalability. - Outsourcing: Consider outsourcing non-core tasks like design, development, and compliance. - Open-Source Tools: Utilize open-source technologies to save development time and costs. - Lean Development: Embrace agile and lean methodologies for iterative development and resource optimization.

The key stages of fintech product development include: Fintech product development involves validating concepts, defining goals, designing interfaces, implementing technology, complying with regulations, rigorous testing, strategic launch, user feedback integration, scaling for growth, and ongoing innovation to meet evolving needs and trends.