What is Core Banking?

‘Core’ is an abbreviation that stands for Centralized Online Real-time Exchange/Environment.

Core banking is a back-end system that processes daily banking transactions and posts updates to accounts and other financial records. These systems typically include deposit, loan, and credit processing capabilities, with interfaces to general ledger systems and reporting tools.

Core banking development refers to the process of designing, building, and maintaining such systems.

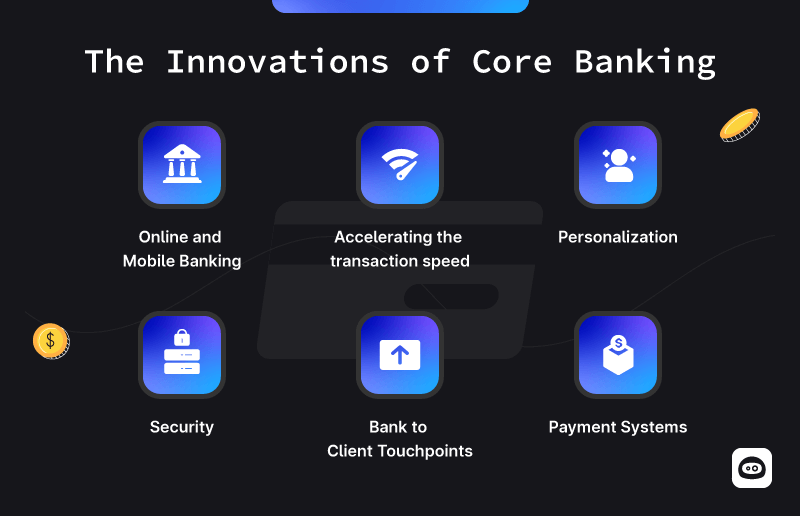

The Innovations of Core Banking

Core banking has seen several significant innovations over the years, transforming the way banks operate and serve their customers. Some key innovations in core banking include:

- Online and Mobile Banking: The advent of the internet and mobile technology revolutionized banking. Customers can now access their accounts, make transactions, and manage finances online or through mobile apps, providing unprecedented convenience and accessibility.

- Real-Time Processing: Long gone are the days of waiting ages for the transactions. Modern core banking systems have shifted from batch processing to real-time transaction processing. This allows for instantaneous updates to account balances, transaction histories, and availability of funds.

- ATM Networks: Automated Teller Machines (ATMs) have become an integral part of core banking, enabling customers to perform a wide range of transactions, including cash withdrawals, deposits, and fund transfers, outside of banking hours.

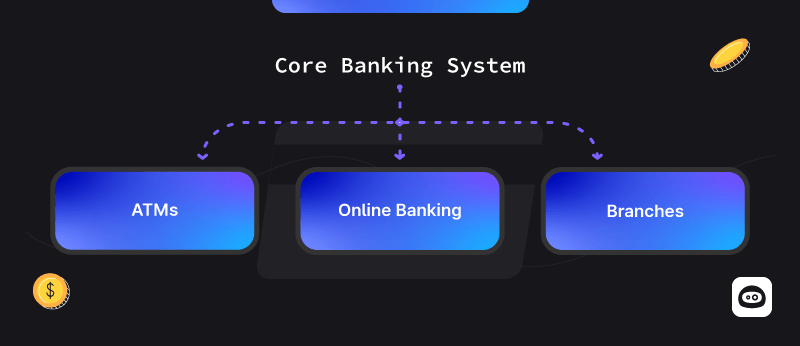

- Multi-Channel Integration: Core banking systems have integrated various customer touchpoints, including online banking, mobile banking, ATMs, and branches. This integration enables seamless cross-channel transactions and consistent customer experiences.

- Personalization: Banks can now use customer data stored in core banking systems to offer personalized products, services, and marketing campaigns. This enhances customer engagement and loyalty.

- Risk Management Tools: Innovations in core banking include advanced risk management tools that help banks assess credit risk, monitor fraud, and ensure regulatory compliance more effectively.

- Blockchain and Cryptocurrency Integration: Some core banking systems have explored blockchain technology and integrated cryptocurrencies into their offerings, enabling customers to hold, trade, and transact in digital currencies.

- Increased security: Core banking systems have adopted biometric authentication methods, such as fingerprint and facial recognition, to enhance security and streamline customer login processes.

- E-Wallets and Contactless Payments: Core banking systems have facilitated the adoption of e-wallets and contactless payment solutions, enabling customers to make transactions with their mobile devices or contactless cards.

These innovations have transformed core banking from traditional, paper-based operations to a more agile, customer-centric, and technologically advanced environment. Banks continue to invest in core banking technology to stay competitive, comply with regulations, and provide innovative services to their customers.

The Key Principles Behind Reliable Core Banking System

Scalability

One of the most critical principles in core banking development is scalability. As a financial institution grows and evolves, its core banking system must be able to adapt seamlessly. Scalability ensures that the system can handle increased transaction volumes, accommodate new products and services, and support a growing customer base without significant disruptions. Scalable systems are built with flexibility in mind, allowing for the addition of new modules and functionalities as needed.

Security

Security is paramount in core banking development. Financial institutions deal with sensitive customer data, financial transactions, and regulatory compliance. Therefore, a robust security framework must be integrated into the core banking system. This includes encryption of data, multi-factor authentication, access controls, and continuous monitoring for potential threats. Ensuring the highest level of security not only protects customers but also safeguards the institution’s reputation and regulatory compliance.

Compliance and Regulation

Financial institutions are subject to a myriad of regulations and compliance requirements, which vary from region to region. Core banking systems must be developed with the ability to adapt and adhere to these regulations seamlessly. Compliance features should be built into the system, and regular updates should be made to stay in line with changing regulatory requirements. Failure to comply with these regulations can result in severe legal and financial consequences.

Integration and Interoperability

Core banking systems do not exist in isolation. They need to interact with various other systems within the institution, such as payment processing, risk management, and customer relationship management. Additionally, they must facilitate external integrations with third-party service providers, such as payment gateways and credit bureaus. Interoperability ensures that data flows seamlessly between systems, enabling real-time information exchange and efficient business operations.

Customer-Centric Approach

A customer-centric approach is crucial in core banking development. The system should be designed to enhance the customer experience, providing easy access to accounts, personalized services, and self-service options. Features like mobile banking, online account management, and chatbots are becoming increasingly important in meeting customer expectations.

Data Management and Analytics

Data is a valuable asset for financial institutions. Core banking systems must have robust data management capabilities, including data storage, retrieval, and analysis. Advanced analytics can provide insights into customer behavior, risk management, and business performance. Harnessing the power of data can help financial institutions make informed decisions and offer tailored products and services to their customers.

Disaster Recovery and Business Continuity

Financial institutions cannot afford downtime. Core banking systems must be designed with robust disaster recovery and business continuity plans. Redundancy, failover mechanisms, and backup systems are essential to ensure uninterrupted service, even in the face of unexpected events such as natural disasters or cyberattacks.

The Cloud Use

Currently, only a limited number of banks have embraced cloud-based platforms to deliver their services. Conversely, banks without dedicated core banking systems often opt to entrust their data to private cloud providers.

Nonetheless, industry analysts and experts foresee a notable shift towards core banking systems as banks embark on modernizing their operations. In this context, the benefits for financial institutions are abundantly clear. Such a transition simplifies banking automation, accelerates the rollout of new services to clients, and allows for installations geared towards optimizing overall performance.

Challenges of core banking software

Core banking software, while offering numerous benefits, also presents several challenges for financial institutions. These challenges include:

- Complex Implementation: Implementing core banking software is a complex and resource-intensive process. It involves data migration, system integration, and often requires a significant change in the bank’s existing processes.

- Costs: The initial investment in core banking software can be substantial. Licensing, customization, hardware, and ongoing maintenance costs can strain a bank’s budget.

- Data Migration: Transferring data from legacy systems to the new core banking platform can be fraught with challenges. Ensuring data accuracy, completeness, and consistency is a critical but arduous task.

- Integration Issues: Banks may already have various third-party systems and applications in place. Integrating these systems with the new core banking software can be complex and may require custom development.

- Vendor Lock-In: Once a bank adopts a specific core banking software, it can become heavily dependent on the software vendor. This can limit flexibility and increase long-term costs if the bank decides to make changes.

- Regulatory Compliance: Core banking systems must adhere to strict regulatory standards. Ensuring that the software complies with evolving regulations and reporting requirements can be challenging.

- Legacy System Maintenance: Transitioning to a new core banking system doesn’t mean the immediate retirement of legacy systems. Banks often need to maintain and support legacy systems during the transition, leading to higher costs.

Despite these challenges, core banking offers a valuable upgrade in terms of efficiency, customer service, and competitiveness. Successfully addressing these challenges often involves careful planning, ongoing management, and a commitment to the long-term benefits of modernizing the banking infrastructure.

Conclusion

The principles of core banking development are fundamental to the success and sustainability of modern financial institutions. A scalable, secure, and compliant core banking system that prioritizes customer-centricity, integration, data management, and disaster recovery is essential to meet the evolving needs of the financial industry.

Core banking development is not just about technology; it’s about enabling the client to get a smooth and protected experience with their finances and your product.

FAQ

Core banking is a back-end system that processes daily banking transactions and posts updates to accounts and other financial records. These systems typically include deposit, loan, and credit processing capabilities, with interfaces to general ledger systems and reporting tools.

Core banking involves managing customer accounts, processing transactions, and calculating interest. It also includes integrating with various systems, ensuring compliance with regulations, and maintaining robust security measures. Scalability and disaster recovery are vital to ensure the system's ability to grow and withstand unexpected disruptions.

Banking encompasses the broader range of financial services offered to customers, while core banking focuses specifically on the technology and systems that enable the execution of these services. Core banking is the backbone that supports the various banking functions, ensuring they operate smoothly and securely.

Core banking systems come in different types to suit specific banking needs: 1. Retail Banking Systems: For individual customers, managing personal accounts and loans. 2. Corporate Banking Systems: Catering to businesses with complex services like corporate credits and treasury operations. 3. Universal Banking Systems: Ideal for large banks serving diverse customer types and offering a wide range of services. 4. Private Banking: Tailored for high-net-worth individuals, offering services like investment management and tax planning.